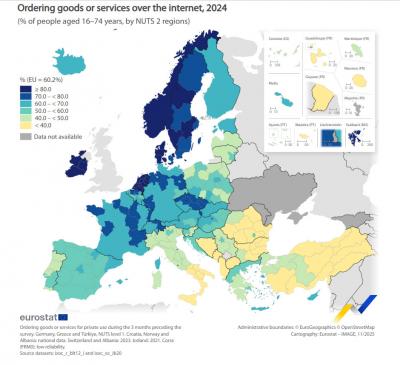

Online shopping across the EU continues to grow, while regional disparities remain significant. According to Eurostat, the share of people ordering goods and services online ranges from 22% to 91% across different EU regions, with the Netherlands, Denmark, Ireland and Sweden among the top performers.

Online shopping across the EU continues to grow, while regional disparities remain significant. According to Eurostat, the share of people ordering goods and services online ranges from 22% to 91% across different EU regions, with the Netherlands, Denmark, Ireland and Sweden among the top performers.Bulgaria is at the bottom of the ranking – only 57% of internet users shop online, compared to an EU average of 77%. The South-East region, including Burgas, has the lowest share of online buyers in the entire EU – 21.7% over the last three months. The reasons are a combination of lower income levels, limited digital skills, low trust in online payments, weaker logistics outside major cities and a persistent „digital divide“ between North-Western and South-Eastern Europe.

At the same time, over 92% of Bulgarian households already have internet access, which clearly shows that the infrastructure is in place and the growth potential for e-commerce is substantial. This turns regions like South-East Bulgaria into high-opportunity markets for online business, local merchants and digital agencies that can help businesses in the region close the digital gap and scale their online sales channels.

Online shopping in the EU and Bulgaria: why is the South-East region lagging behind?

E-commerce is no longer a „new trend“ – it is a mature part of the daily life of millions of Europeans. However, the latest Eurostat data show that the online landscape across the European Union is highly uneven: while in some regions over 90% of people shop online, in others their share remains around or below 25%. At the very bottom of this ranking is the South-East region of Bulgaria – the region that includes Burgas. (European Commission)What the EU data tell us

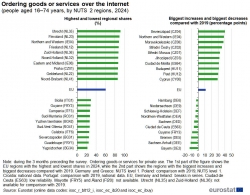

According to Eurostat’s 2024 study „Online shopping from 22% to 91% across EU regions“, in 23 NUTS 2 regions of the EU at least 80% of the population aged 16–74 had ordered goods or services online during the three months preceding the survey. Almost half of these regions are in the Netherlands – all twelve Dutch regions are above this threshold. They are joined by all regions in Denmark and Ireland, three regions in Sweden and the capital region of the Czech Republic (Prague). (European Commission)On the published chart with the highest and lowest regional values, the Utrecht region (Netherlands) clearly stands out – over 91% of people there have shopped online. It is followed by Flevoland and other Dutch regions, as well as the Irish Northern and Western region. At the other end of the scale, in the lower part of the same chart, we see several Italian and French regions, France’s overseas territories, the Portuguese region of Madeira and two Bulgarian regions. (European Commission)

At country level, the picture is equally clear. In the EU in 2024:

- 94% of people aged 16–74 used the internet in the last 12 months;

- 77% of internet users ordered goods or services online during the same period;

- the highest share of online buyers among internet users is in Ireland (96%), the Netherlands (94%) and Denmark (91%).

Where does Bulgaria stand compared to other countries?

Bulgaria is at the opposite end of the spectrum. According to Eurostat’s EU-wide 2024 survey on online shopping, our country has the lowest share of internet users who shop online – 57%, versus an EU average of 77%. Italy and Romania follow with 60% each.At the same time, Bulgarian households are increasingly connected. In 2024, 92.1% of households in Bulgaria had internet access at home – 94.7% in urban areas and 84.3% in rural areas. (NSI - National Statistical Institute)

This means that the challenge is not the lack of technical access, but rather how the internet is used – in this case, for e-commerce and digital transactions.

The regional picture in Bulgaria

NSI data, harmonised with Eurostat, provide an even clearer view when we look at the regional level (NUTS 2). In 2024, the share of people (aged 16–74) who purchased goods or services online in the last 3 months was:Total for Bulgaria: 33.3%

- South-West (Sofia and region): 44.7%

- North-Central: 36.8%

- North-East: 33.1%

- South-Central: 26.5%

- North-West: 24.9%

- South-East: 21.7%

Alongside it, only two other regions are below 25%: the French overseas region of Guadeloupe and the North-West region in Bulgaria.

In other words:

European statistics place the South-East region literally at the very bottom of the EU in terms of propensity for online shopping.

Why is the South-East lagging behind? Possible explanations

Statistics do not provide direct „reasons“. However, based on public data and existing research, several key factors can be identified.1. Income levels, employment and economic structure

The South-East region is characterised by pronounced seasonality (tourism along the Black Sea coast) and a significant share of traditional industries – manufacturing, agriculture, logistics. In such economies, wages and employment tend to be more volatile, and consumer spending is more cautious. Eurostat data on regional income and risk of poverty show that many regions in Eastern and Southern Europe – including in Bulgaria – remain below EU averages. (European Commission)Lower incomes mean less disposable spending power and more conservative consumer behaviour – including a slower shift towards online shopping and a strong preference for the familiar „corner shop“.

2. Digital skills and trust

European and national reports indicate that Bulgaria lags behind in key indicators for digital skills and the adoption of digital services, despite progress in e-government.With lower levels of digital literacy, users tend to:

- struggle with navigating online stores and e-commerce applications;

- fear making mistakes during online payment;

- worry about misuse of personal data and online fraud.

3. Urban–rural and intra-regional disparities

Official statistics show that the share of people who shop online is significantly higher in urban areas than in rural ones. (Source: NSI)The South-East region combines a dynamic coastal hub such as Burgas with extensive rural and semi-rural territories inland. With such a structure, it is likely that:

- in larger cities, online shopping penetration is close to the national average;

- while in smaller settlements it remains significantly lower.

4. Logistics

Bulgarian e-commerce market analyses highlight that logistics is one of the main friction points – delivery times, costs and service quality, especially outside major cities. (balkanecommerce.com)When delivery to a small town or village is slower, more expensive or operationally inconvenient (no local courier office, limited pick-up slots), the incentive to order online is significantly reduced.

5. Historical lag and the „digital divide“

European studies on the regional „digital divide“ show persistent gaps between Northern/Western and South-Eastern Europe in terms of internet use and e-commerce adoption, which tend to reproduce themselves over time. (Idus)The South-East region has traditionally been weaker in indicators such as innovation capacity and broadband coverage. This historical lag cannot be closed within just a few years.

What does this mean for Burgas and the region?

The fact that the South-East region of Bulgaria ranks last in the EU for online shopping is not a „verdict“. It is a signal of untapped potential. The country already has:- • over 92% of households with internet access;

- • almost 50% of individuals shopping online at least once a year; (NSI - National Statistical Institute)

- • a fast-growing e-commerce sector that already accounts for over 2% of GDP, yet still below average EU benchmarks.

(1) Business opportunity – local companies that invest in high-performing websites, online stores and digital sales channels have the chance to become first movers and secure leading positions in a market that is far from saturated and is expected to catch up with the rest of the EU.

(2) Education and digital skills – schools, universities, libraries, municipalities and NGOs can focus programmes on practical digital literacy – online payments, cybersecurity, fraud prevention, and consumer rights in a digital environment.

(3) Infrastructure and logistics – every investment in better fulfilment and last-mile solutions (local hubs, more flexible courier services, automated parcel lockers) increases the business case for online shopping and improves customer experience.

Instead of a conclusion

European maps and dashboards are not just „statistics“ – they show where we stand today and what our strategic direction can be tomorrow. At this moment, the South-East region of Bulgaria is at the very bottom of the EU in terms of online shopping penetration. But the same data clearly highlight something else:- internet access is already widely available;

- consumers are gradually adopting online shopping;

- companies and institutions have a strong interest in accelerating this transition.

Why is the South-East region of Bulgaria last in the EU for online shopping?

It’s the result of several overlapping factors: lower income levels, seasonal employment, weaker digital skills, low trust in online payments, more complex logistics outside major cities and a persistent “digital divide” between North-Western and South-Eastern Europe.

How is it possible to have over 92% of households online and still so few online buyers?

The infrastructure is there, but the internet is often used mainly for social media and entertainment. There is a lack of habits, confidence and know-how for secure online shopping, and a significant share of users remain sceptical about paying over the internet.

What differentiates South-East Bulgaria from other regions in the country?

The region combines a developed coastal hub (Burgas) with extensive rural and semi-rural areas. In the cities, online shopping is closer to the national average, but low activity in smaller settlements “pulls down” the overall regional figures.

What are the main barriers to e-commerce in smaller settlements?

Weaker courier coverage, higher delivery costs and longer lead times, inconvenient parcel pick-up windows and lower trust in online payments. As a result, the physical store often remains the preferred purchase channel.

Is there potential for e-commerce growth in the South-East region?

Yes. High internet penetration, the growing share of online buyers at national level and increasing interest in digital services show that the region is “late to the game”, but has strong untapped potential for e-commerce and digital business models.

What do these data mean for local businesses?

Local companies that invest in a quality website, a reliable online store and digital sales channels in time can secure leading positions in a market that is still far from saturated. The region’s current lag is, in practice, an opportunity for early and strategic positioning.

How can municipalities, schools and NGOs help close the gap?

By launching digital literacy programmes, training on secure online shopping, awareness campaigns about consumer rights and by encouraging local businesses to offer online services and digital payment options.

What is the role of digital agencies in this process?

Digital agencies such as Smartweb can deliver an end-to-end strategy – from building a modern website and online store, through UX and SEO optimisation, to performance marketing and sales automation. This helps local businesses bridge the digital gap faster and turn regional specifics into a competitive advantage.

.jpg)